While seller financing can be a flexible and accessible option to traditional mortgage lending, it is essential that buyers in seller-financed transactions receive accurate mortgage disclosures, particularly those detailing fees and costs. Disclosures not only ensure transparency and legal compliance but also foster trust and minimize risk for both parties. Here's a comprehensive look at why these disclosures matter, what’s required, and how to do it right.

Why Mortgage Disclosures Matter in Seller Financing

During a traditional mortgage, lenders must provide buyers with disclosures that outline loan terms, fees, and borrower rights. When a seller finances the transaction, they essentially become the lender, which means they may also be responsible for certain disclosures under federal and state laws. These disclosures help protect both parties by ensuring:

- Full transparency regarding the loan terms

- Compliance with lending regulations

- A clear understanding of financial obligations

Even if a seller is exempt from certain federal rules due to the limited number of transactions, providing disclosures voluntarily is a best practice that builds trust and clarity. Buyers who are well-informed of the loan requirements are more likely to make their consistent and timely payments.

Ensuring Transparency and Trust

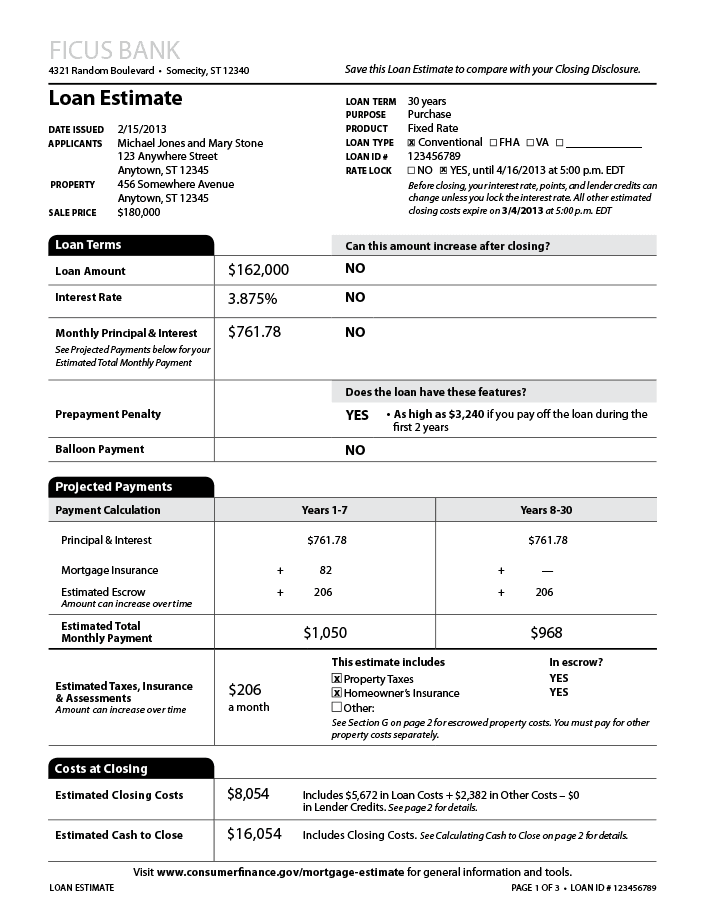

Traditional mortgage transactions require standardized disclosures, such as the Loan Estimate, Closing Disclosure, Servicing Disclosure Statement, Homeownership Counseling Disclosure, Affiliated Business Arrangement Disclosure, Notice of Right to Rescind, and Borrower Authorization. Many states also have specific disclosure requirements. While seller financing may not fall under the same regulations, mirroring these practices creates a sense of professionalism and openness. Buyers should fully understand their financial obligations, including interest rates, loan terms, rights, and any closing fees.

Preventing Unexpected Costs

Without proper disclosures, buyers might face unforeseen expenses. Sellers should clearly document:

- Origination or administrative fees

- Monthly payment fees

- Balloon payments

- Late payment or pre-payment penalties

An itemized breakdown of these costs allows buyers to plan and avoid financial surprises.

Avoiding Legal Disputes

A lack of clear disclosures can lead to disputes and even legal action. By documenting all fees and loan terms upfront, sellers protect themselves from claims of misleading practices and minimize the risk of future regulatory issues.

Aligning with Best Practices in Lending

Providing clear, written disclosures ensures that seller-financed deals resemble professional mortgage agreements. This can help reassure buyers who may be hesitant to pursue non-traditional financing.

Empowering Buyers to Compare Financing Options

When sellers offer detailed disclosures, buyers can compare the real cost of seller-financing against other loan options. This transparency enables buyers to make informed decisions based on actual costs rather than assumptions.

Key Disclosures Sellers Should Provide

1. Loan Estimate and Closing Disclosure

While not always required by law in seller-financed deals, providing a Loan Estimate and Closing Disclosure can go a long way in promoting transparency. These documents typically outline:

- Interest rate and loan terms

- Monthly principal, interest, taxes, insurance, and association dues (if applicable)

- A breakdown of closing costs and fees

- Cash needed to close

Using these standardized forms helps ensure buyers understand the true cost of financing and prevents confusion or surprises at closing.

2. Promissory Note & Loan Agreement

This formal agreement should outline:

- Loan amount and interest rate

- Payment schedule

- Penalties for late payments

- Consequences of default

3. Seller Financing Addendum

Often required by states, this document details:

- Loan terms and interest

- Balloon payment requirements

- Due-on-sale clauses

Best Practices for Sellers

- Use Clear, Simple Language – Ensure buyers understand all terms.

- Keep Copies of All Documents – Both parties should retain signed copies.

- Ensure State Compliance – Check for state-specific disclosure rules.

- Keep Track of Payment History – A payment collection service can help with compliance and payment tracking.

- Consider Working with a Professional – Consult a mortgage expert.

Conclusion

While seller-financed transactions offer unique advantages, they should not lack the transparency and protections of traditional mortgage deals. Providing accurate, clear mortgage disclosures—especially around fees—ensures trust, minimizes legal risks, and aligns with ethical lending practices. By taking this extra step, sellers can create smoother, more secure transactions that benefit everyone involved.

Promissa is building a comprehensive, all-in-one solution for seller financing in real estate transactions. Our mission is to create a seamless platform bridging the gap between buyers and sellers, ensuring security and fraud protection for both parties. Would you like help navigating a seller-financed transaction? Promissa simplifies the process, ensuring security and compliance every step of the way.

Header Image Source: Photo by RDNE Stock project on Pexels. Link to Image

.jpg)

.jpg)